What is BIM?

BIM, which is the acronym for Building Information Modelling is not new. In fact, BIM as a concept was first developed in the 1970s. The acronym BIM crept into existence sometime in the late 1980s and the protogenic BIM software, albeit quite limited in its functions, was first issued in the mid 1990s. Nowadays, the technology has progressed to such an efficiency that most developed construction markets, irrespective of location, have shifted to BIM.

Such is the level of growth and acceptance of BIM that in 2011, just 13% of industry professionals surveyed by UK construction software provider NBS were actively using BIM software, and 43% had yet to hear of the technology. A decade on, according to the annual NBS BIM Report, 73% of practices now use BIM, while just 1% remain unaware.

A very apposite yest easily comprehensible explanation of what BIM is and how it functions is that it is software which creates digital representations of the physical and functional characteristics of spaces. In short, it is software which is used to plan, design, construct, operate and maintain buildings.

In truth though, BIM is much more than mere computer software. It is a new construction process centred around the complete collaboration of all the parties involved in the construction process through the sharing of information throughout the planning and construction process in real time

BIM software allows for the creation of the 3D models of what is actually to be built so that the Employer, Architect, Contractor, Civil engineer, M&E engineer, QS and Interior Designer can use the model to control the design, cost and the construction process itself. Most significantly BIM is relied upon as a tool for quick and independent problem identification and remedial decision-making, from project inception to handover. BIM is naturally most beneficial when implemented at the beginning of project so that the planning and tendering process is done through BIM. Thereafter the model can be further developed as the project moves along its life cycle.

What does BIM do?

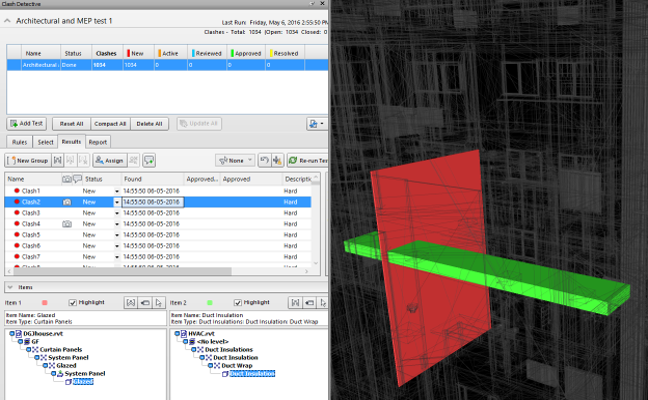

Simply put, everyone associated with the project works and in fact designs and builds using the same 3D model and all aspects of the planning and design are inputted into the BIM software. Any and all matters and/or issues relating to every aspect of the construction process are viewable to all and can be resolved so as to identify and eradicate any potential error before an error occurs or to deal with any necessary alteration of any aspect of the project.

A notable and, in terms of Cyprus, very relevant example of BIM operation is the instance of a variation. A variation, once decided upon will be inserted into the 3D BIM model by the Architect and is instantly and contemporaneously viewed by all other parties. In principle the cost of the variation can be calculated by the software itself since the software can be linked to the BOQ. Also, the software, which is linked to the planning and construction schedules can be used to develop the extension or saving of time calculation that the variation warrants. Then the Contractor and any other party whose work is affected by the variation proceeds with its execution, thereby minimising the potential or time wasting and costs involved in disputing or arguing about the implications in time and costs in relation to the variation.

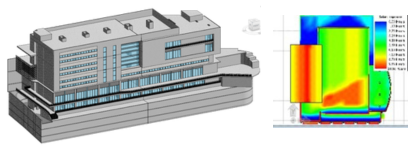

BIM and Sustainability

We are all becoming aware of the need for sustainability. The BIM model can interact with specific sustainability software to carry out sustainability analysis so as to achieve optimum comfort and design optimisation as well as energy efficiency.

It is significant to note that one is able to track and attain Sustainability Certifications by the interlinking of BIM and sustainability software.

Finally, BIM software also allows for facility management as it may be integrated with computer-aided Facility Management Systems to ensure a smooth transition from the handover stage to the facility management stage once the project is completed and the Employer takes over its operation.

When BIM is utilised by a proficient Project team, the software allows for the archaic 2D modelling (i.e. plans on paper) construction process to move to 7D.

The 7 dimensions are as follows:

3D = Interactive plans

4D = Time calculation

5D= Cost calculation

6D= Sustainability

7D= Facility Management

How will BIM change the Cypriot construction industry?

Through BIM design, issues will be identified and resolved before they enter the critical path for construction. This means that parties will no longer be forced to argue about cost and extension of time claims since these factors will be calculated by the BIM software itself.

Projects will be planned and executed in the most cost effective and sustainable manner and budgets will be monitored much greater accuracy.

The adoption of BIM will effectively usher in a new era of construction in which most disputes associated with the construction process are resolved by the software itself. One can only imagine the decrease in cost to the public purse if government projects were tendered for and constructed with the use of BIM.

At the same time Contractors bidding for government projects will benefit from the increased certainty, transparency and objectivity that BIM will introduce. As a result the market will become much more competitive due to the renewed confidence in how the project will be run.

Most importantly BIM will promote greater confidence, cooperation and trust in the beleaguered construction industry of Cyprus due to the minimisation of disputes that lead to delays in payments and protracted and increasingly expensive legal disputes.

An Employer who uses the BIM model will benefit from more competitive prices due to the elimination of the uncertainties that BIM can achieve.

Even though constructing with the use of BIM has a cost, this cost is by no means restrictive in large development and public projects. In fact the opposite is the case. By using BIM the Employer, whether private or the government will end up saving money for the plethora of reasons outlined above.

BIM vs Lawyers

One could think that BIM could spell bad news for lawyers since the software eliminates many of the reasons for disputes that occur during the construction process. This is, however not the case. Recent case law in the United Kingdom and in the US has flagged up a plethora of BIM related legal disputes. After all, BIM works through human input. BIM has not yet reached the stage where it can eliminate human error. As shown above BIM can greatly reduce the effects of human errors as it can identify it and possibly aid in resolving the effects of it on site but the capacity for human error still remains a risk.

Recent disputes that have reached the courts have involved questions like:

Determining liability: Questions arise as to who bears responsibility for design errors and other human errors imputed into the BIM software. If numerous parties are sharing and using the same model then it becomes harder to ascertain who is at fault for the error once the error occurs.

Responsibility issues: A breakdown of communication can occur when not all parties on the project are using BIM (which sometimes is precisely the case). Sometimes the project might be both on BIM and on 2D plans which if not checked thoroughly might have discrepancies between them which can lead to errors which are then built into the project, and which will have to later me remedied.

Finally, ownership / title issues: Disputes as to who has ownership and/or copyright of the BIM software relating to a project are the most common form of dispute. This usually happens when there is a breakdown in relationship and the party most in control of the BIM pulls the plug and locks the other parties out of using it to finish the project.

With the above in mind, even though BIM will help prevent or resolve a large percentage of traditional disputes, it will not go as far as to eradicate disputes altogether. Even with BIM, disputes as to workmanship, design, cost and time will still occur, but simply to a lesser extent. Coupled with the BIM related disputes mentioned above there will still be ample ground for lawyers to “cross swords” in construction.

Parties will therefore do well to look to lawyers with the relevant legal experience and expertise in understanding BIM, its implementation and the legal issues that arise through its use. Contract clauses will have to be drafted with BIM usage in mind and parties will need to incorporate the use of this technology in the actual terms of the contract itself, both in relation to the terms relating to the construction as well in relation to the clauses regulating the dispute resolution mechanisms of the contract. Simply put, lawyers will not be out of a job anytime soon but rather their scope of operations will evolve to include BIM.

Using BIM now

Readers operating in the Cypriot construction industry may be excused for thinking that BIM is years away from becoming a significant factor in the Cypriot construction industry. We are however confident that that is not the case and the situation will change rather rapidly.

One of the main reasons supporting this view is the commonly held belief that the current state of the construction industry in Cyprus is not sustainable. This is one of the few things that both Employers and Contractors agree upon.

The time is therefore ripe for the introduction of BIM into the construction market. In this context it is significant to note that BIM can be used on a project even if all parties to the process do not yet know how to use and/or do not yet have access to the relevant software. The fact of the matter is that if an Employer wishes it to be so, any Cypriot project can be run on BIM starting tomorrow.

We are currently working with construction professionals operating in Cyprus with long standing international experience working with BIM. They are very well placed to advise on and to provide BIM implementation by assisting clients in the construction and development of the models required for BIM to operate on a project and in setting out the necessary BIM process and procedures in relation to the project, irrespective of its stage of development or construction.

For any related queries and/or more information on how BIM can be put to use on your construction project please contact the Construction and Real Estate team at Ioannides Demetriou LLC.

All photos and model depictions used in this article are the property of and have been graciously provided by DG Jones and Partners (www.dgjones.com).